The Ultimate Beginner’s Guide to ETFs

What they are, why they exist and how to decode all the jargon.

If you’ve ever opened your brokerage account and looked at ETFs, you’ve probably been overwhelmed by names like:

“iShares MSCI World UCITS ETF (Acc) – USD (Dist)”

…or codes like IE00B4L5YC18 or LU0274208692.

This guide will make sense of it all. Simple, clear, and practical.

✅ What Is an ETF?

ETF = Exchange-Traded Fund.

It’s basically a basket of assets (usually stocks or bonds) that you can buy and sell on the stock exchange like a single stock. And the best thing is, you can - of course - have multiple ETFs to diversify even more.

Why They Exist:

Before ETFs, you had to either buy individual stocks (risky and time-consuming) or invest in mutual funds (expensive, less flexible).

ETFs changed the game by offering:

Low costs

Instant diversification

Liquidity (you can buy/sell anytime the stock market is open)

The first ETF was launched in 1993 in the U.S. (SPDR S&P 500 — ticker: SPY).

In Europe, ETFs became popular after the 2000s, especially through UCITS ETFs.

The Growth Explosion:

Late 1990s: More ETFs were launched in the U.S., covering different indices like Nasdaq, Dow Jones.

Early 2000s: Europe started adopting ETFs with UCITS-compliant funds becoming popular.

2008 Financial Crisis: Investors fled high-fee funds, leading to a boom in passive investing.

2010s–2020s: ETFs expanded into:

Thematic ETFs (tech, clean energy, AI)

Bond ETFs

Dividend ETFs

ESG ETFs

Even Bitcoin ETFs (approved in the U.S. in 2024).

Today, there are 8,000+ ETFs globally, with over $12 trillion in assets under management (AUM).

🧑💼 Key Players in ETF History:

Nathan Most (State Street): Often called the “father of ETFs”, designed the SPY ETF.

State Street, iShares (BlackRock), and Vanguard: The “Big Three” ETF providers who control most of the market today.

Jack Bogle (Vanguard): Revolutionized low-cost index investing (though he famously didn’t like ETFs because of the temptation to trade them).

ETFs were invented to democratize investing, offering cheap, liquid, and transparent access to diversified portfolios.

They’ve evolved from niche products to the default choice for modern long-term investors.

📜 What Is UCITS?

UCITS = Undertakings for Collective Investment in Transferable Securities (EU regulation).

It’s basically a European label that ensures:

Investor protection

Transparency

Diversification rules (e.g., no single company can make up more than 20%)

💡 UCITS ETFs are usually safer and more regulated — many investors prefer them even outside Europe.

🔤 Common Abbreviations Explained

| Abbreviation | Meaning | What It Tells You |

|---|---|---|

| Acc or A | Accumulating | Dividends are reinvested, you don’t get payouts. |

| Dist or D | Distributing | Dividends are paid out to your account. |

| USD / EUR / GBP | Currency | Which currency the fund is denominated in — NOT the companies inside! |

| Hedged | Currency Hedged | Tries to neutralize currency fluctuations, especially useful in volatile forex environments. |

| ESG | Environmental, Social, Governance | Focus on “ethical” or “sustainable” companies. |

| UCITS | Undertakings for Collective Investment in Transferable Securities | ETF is issued under EU regulation (s. above) |

🏷️ What Are ISIN, WKN, and Ticker Symbols?

| Term | Meaning |

|---|---|

| ISIN | International Securities Identification Number — unique global identifier (e.g., IE00B4L5YC18) |

| WKN | Wertpapierkennnummer — German securities number (e.g., A0RPWH) |

| Ticker | Exchange-specific short code (e.g., EUNL on Xetra, SPY on NYSE) |

📝 ISIN is the most reliable identifier globally.

🧰 Physically vs. Synthetically Replicated ETFs

| Type | Meaning | Why It Matters |

|---|---|---|

| Physical Replication | Fund actually buys the underlying stocks | More transparent, preferred by long-term investors. |

| Synthetic (Swap-Based) | Fund uses derivatives/swaps to mirror performance | Can reduce costs/taxes, but higher counterparty risk. |

Europe usually favors physical, but synthetics exist for hard-to-access markets (e.g., China A-shares).

🏢 The Major ETF Providers (and Their Codes)

| Provider | Branding | Common Abbreviations |

|---|---|---|

| iShares (BlackRock) | iShares | Core = cheap range (e.g., IWDA), UCITS ETFs |

| Xtrackers (DWS) | Xtrackers | X- = Xtrackers, often low cost |

| Lyxor (now Amundi) | Lyxor / Amundi | LYXOR/AMUNDI ETFs, often specialist themes |

| Vanguard | Vanguard | Famous for ultra-low fees, e.g., VUSA (S&P500) |

| SPDR (State Street) | SPDR | Oldest ETFs, e.g., SPY (US S&P500) |

| Invesco | Invesco | Known for factor ETFs (dividend, value, etc.) |

💡 What to Look Out for Before You Buy

Fund Size

- Prefer ETFs with €500M+ assets under management (AUM) for liquidity and stability.

Fund Age

- Avoid ETFs younger than 3 years unless you have a specific reason.

TER (Total Expense Ratio)

- Lower is better; 0.07%-0.25% is standard for broad indices.

Replication Type

- Physical is generally safer; synthetic sometimes useful.

Domicile

- Ireland (IE) and Luxembourg (LU) domiciled UCITS ETFs often have better tax treaties.

Currency Risk

- Base currency ≠ investment currency. A USD-denominated ETF can hold global stocks.

Dividend Preference

- Acc = compound quietly; Dist = get payouts.

What Is TER (Total Expense Ratio)?

TER = Total Expense Ratio, and it’s one of the most important numbers to look at when picking an ETF.

✅ What Does It Mean?

The TER tells you how much the fund charges you each year to manage the ETF, expressed as a percentage of your invested amount.

Example:

- If an ETF has a TER of 0.20% and you invest €10,000, you’ll pay €20 per year in fees (automatically deducted, you won’t see an invoice).

✅ What’s Included in TER:

Fund management fee

Operational costs (auditors, legal, administrative)

Custody fees

❗ What’s Not Included:

Broker transaction fees (what you pay to buy/sell on your broker)

Bid-ask spread (the difference between buying/selling prices on the exchange)

Currency conversion costs (if applicable)

📉 Why Low TER Matters

Compounding impact: A small % makes a huge difference over 10–20 years.

Passive investing goal: ETFs aim for market returns — high fees eat into that return.

Low-fee competition has driven TERs below 0.10% for big index ETFs like MSCI World or S&P 500.

| TER Range | Typical Use Case |

|---|---|

| 0.07–0.25% | Broad indices like MSCI World, S&P 500 |

| 0.25–0.60% | Sector ETFs (tech, healthcare), ESG variants |

| 0.60–1.00%+ | Niche themes (AI, biotech), emerging markets |

Rule of thumb:

If two ETFs track the same index, always prefer the one with the lower TER, assuming size and age are comparable.

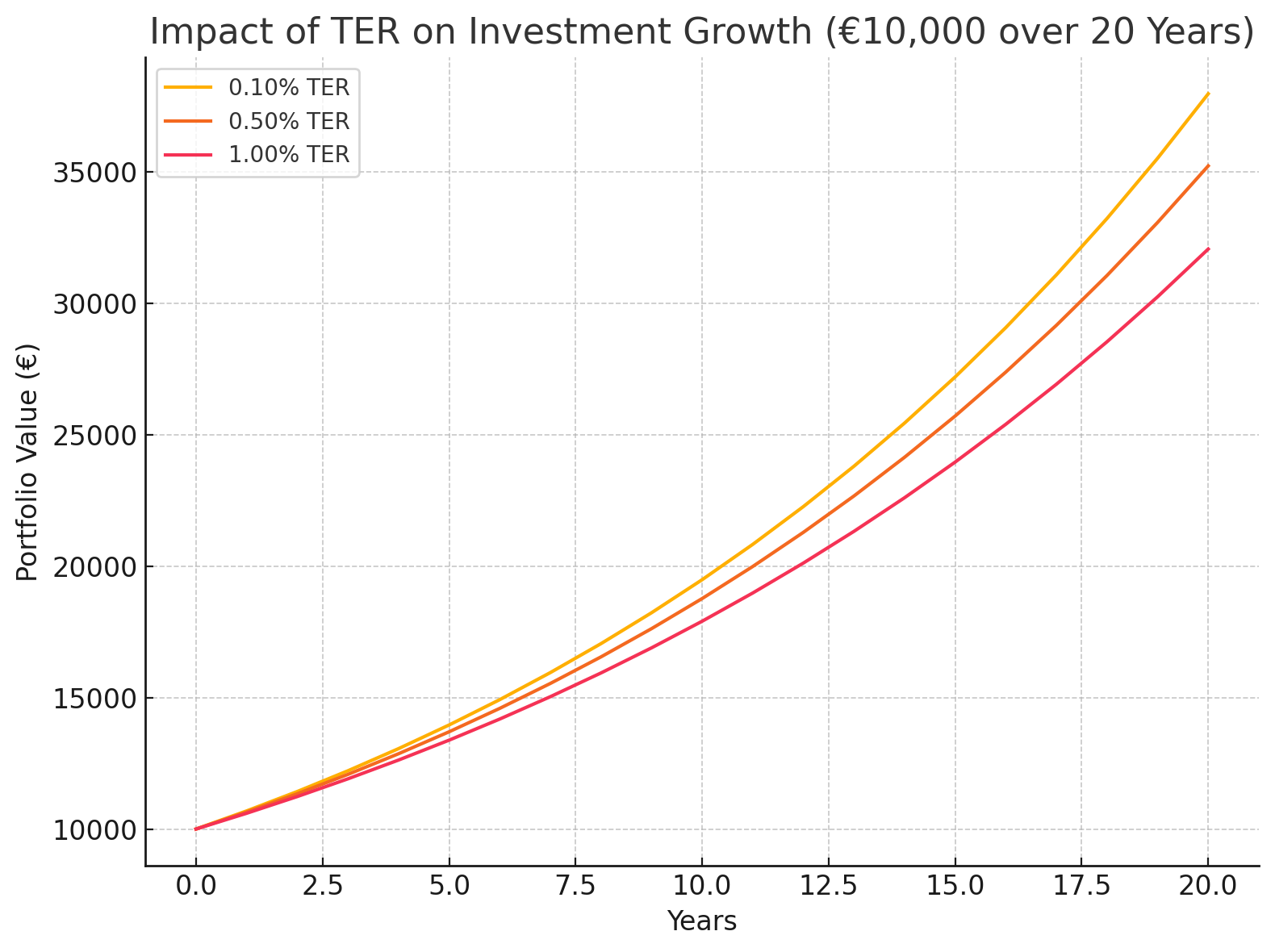

Here’s a clear example:

With 0.10% TER, your €10,000 grows to about €38,000 after 20 years.

With 0.50% TER, it grows to around €34,000.

With 1.00% TER, it only grows to roughly €30,000.

Small fees compound into big differences over time — this is why low TER matters so much, especially for long-term investing.

🧐 What’s Inside the ETF?

EFTs bundle various stocks into one big bucket. Some buckets are huge, like the MSCI World ETFs or the All World ETFs, some are small and niche, like some "green" ETFs or ETFs focused on biotech or robotics. Make sure you understand what is included and if that is what you would like to invest in.

What's included, can be found in the factsheet which is usually a short pdf that you can download.

Always check the factsheet:

Index tracked (MSCI World? S&P 500? Nasdaq?)

Top holdings (often the top 10 dominate!)

Country/sector breakdown

Rebalancing frequency

Weighting method (market cap, equal weight, etc.)

Quick Recap

| ✅ Do | ❌ Avoid |

|---|---|

| Choose big, established ETFs | Tiny, niche ETFs with low volume |

| Understand acc vs. dist | Blindly buying based on “World” in the name |

| Check fund domicile & TER | Ignoring tax implications (e.g., US-domiciled ETFs have withholding taxes) |

| Use ISIN to verify funds | Relying solely on brand names or tickers |

Final Thoughts

ETFs make investing simple — but only if you understand the basics.

With this guide, you can read those intimidating fund names and see exactly what you’re buying.

And don't worry - you probably will make mistakes. I sure have. My portfolio is solid, but not perfect. As I learn more, I discovered some mistakes I made when I just started out. This is not the end of the world. Mistakes can be corrected most of the time.

If you would like to learn more and start investing with peace of mind, sign up for the waitlist for “Mystery Money” - a self-paced online video course where I demystify all the jargon for you, help you get into the right money mindset and start investing with confidence. 💖